stamp duty exemption malaysia 2017

Our experienced journalists want to glorify God in what we do. The law does provide for a stamp duty exemption for a transfer of property by way of love and affection.

Kw Malaysia Positive About Stamp Duty Exemption Expected More Measures To Boost Property Market Edgeprop My

For First RM100000 RM1000 Stamp duty Fee 2.

. In addition to the above stamp duty is imposed on the total proceeds ie. Malaysia has a wide variety of incentives covering the major industry sectors. Stamp duty is the tax you pay your state or territory government when buying a property.

Following Israels social justice protests in July 2011 Prime Minister Benjamin Netanyahu created the Trajtenberg. But remember if you are a first home buyer many States. This custom duty rate is leviable on all goods imported into Malaysia.

In contrast pursuant to the Stamp Duty Exemption No. Can owner-occupiers claim stamp duty. NSW Stamp Duty exemptions.

In general stamp duty primarily occurs in connection with registration of rights regarding property and land. Below are changes to foreign property ownership that the Government proposed in the Federal Budget 2017. If youre a first home owner in Victoria you wont have to pay any stamp duty if your property is valued at less than 600000 and you entered into your contract after 1 July 2017.

When goods are exported outside India the tax is known as export custom duty. Value of the transaction from buying or selling any kind of stockssecurities with very limited exceptions for the T-bills and T. Singapore-headquartered multinational enterprises MNEs meeting certain conditions are required to prepare and file CbC Reports to IRAS for financial years FYs beginning on or after 1 Jan 2017.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Tax incentives can be granted through income exemption or by way of allowances. Latest breaking news including politics crime and celebrity.

Russia has agreements with scores of countries whose citizens are either exempt from visas or can apply. The tax collected by Central Board of Indirect Taxes and Customs. Stamp duty is levied in the UK on the purchase of shares and securities the issue of bearer instruments and certain partnership transactions.

The visa policy of Russia deals with the requirements which a foreign national wishing to enter the Russian Federation must meet to obtain a visa which is a permit to travel to enter and remain in the countryVisa exemptions are based on bilateral or multilateral agreements. Stamp duty is charged on transfer of Hong Kong stock by way of sale and purchase at 026 of the consideration or the market value if it is higher per transaction. Its modern derivatives stamp duty reserve tax and stamp duty land tax are respectively charged on transactions involving securities and land.

After public consultation the government released a progress paper as an update on the proposal. Stamp duty Fee 1. When goods are imported from outside the tax known as import custom duty.

East Coast Economic Region Malaysia ECER as the Gateway to the Asia Pacific Region offers competitive incentives such income tax exemption of 100 for 10 years stamp duty exemption on land or building purchased for development customised incentives and also non-fiscal incentives to approved companies. Value of the transaction from buying or selling any kind of stockssecurities with very limited exceptions for the T-bonds and T-bills regardless of whether they are Egyptian or foreign listed or non-listed without deducting any costs where buyer and seller. Find stories updates and expert opinion.

Visas typically include limits on the duration of the foreigners stay areas within the country they may enter the dates they may enter the number of permitted visits or if the. Stamp duty has the effect of discouraging speculative. The buyer will be entitled for a stamp duty exemption for the MOT and only need to pay a nominal fee of RM10 provided.

Raw materials that are imported into the country enjoy a tariff exemption or a reduced tariff rate. 10 Order 2007 the law provides for stamp duty exemption for a transfer of property between family members by way of love and affection as follows. A visa from the Latin charta visa meaning paper that has been seen is a conditional authorization granted by a polity to a foreigner that allows them to enter remain within or leave its territory.

This Order comes into force on 01012021. Previously foreign residents were subject to Capital Gains Tax. When a motor vehicle is registered in Denmark for the first time a registration duty must be paid.

This is applicable if those materials will be used to manufacture goods that will be exported. There are also special tax incentives for new immigrants to encourage aliyah. As per the publication such stamp duty is imposed on the total proceeds ie.

In February 2020 as part of Indias. Get the latest international news and world events from Asia Europe the Middle East and more. The Actual Calculation of Stamp Duty is before first-time house buyer stamp duty exemption.

Must contain at least 4 different symbols. Heres your guide to when a stamp duty tax deduction applies. In November 2020 the NSW government announced plans to phase out stamp duty in favour of an annual property tax.

First-home buyers looking at properties valued between 600000 and 750000 also receive a concessional rate of stamp duty. Stamp duty is enacted on the disposal of shares as per the publication number 24 in the official gazette published on 19 June 2017. Stamp Duty Exemption on Memorandum of Transfer.

Transferor Transferee Exemption Rate. The Sales and Services Tax SST The SST tax in Malaysia was reintroduced in 2018. RM100001 To RM500000 RM6000 Total stamp duty must pay is RM700000 And because of the first-time house buyer stamp duty exemption you can apply for the stamp duty exemption.

In particular you need to be aware of taxes for leaving your property vacant stamp duty foreign citizen stamp duty land tax and capital gains. Currently there are some circumstances where you may be able to avoid or reduce stamp duty such as being a. Taxation in Israel include income tax capital gains tax value-added tax and land appreciation taxThe primary law on income taxes in Israel is codified in the Income Tax Ordinance.

6 to 30 characters long. The vendor claims an exemption from a law that prohibits discrimination on the basis of sexual orientation. ASCII characters only characters found on a standard US keyboard.

Custom Duty is an indirect tax levied on import or export of goods in and out of country. Stamp duty exemption on instruments of transfer of real property or lease of land or building used for the purpose of carrying on a qualifying activity executed on or after 13 June. Unfortunately home buyers who plan to live in the property they buy cannot claim stamp duty as a tax deduction.

In the latest Stamp Duty Exemption Order 2021 PUA 53 on instrument of transfer such as Memorandum of Transfer MOT. Furthermore insurance documents are liable to stamp duty if the risk is situated in Denmark. If no exemption is applied the property tax paid can be used to offset against the profits tax payable by the corporation.

Watson and Hartley argue that such an exemption is illegitimate even if same-sex couples can avail themselves of the services of other vendors in the area.

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Malaysians Guide To The Latest Property Stamp Duty Iproperty Com My

Propertyguru Property Market Abound With Affordable Options

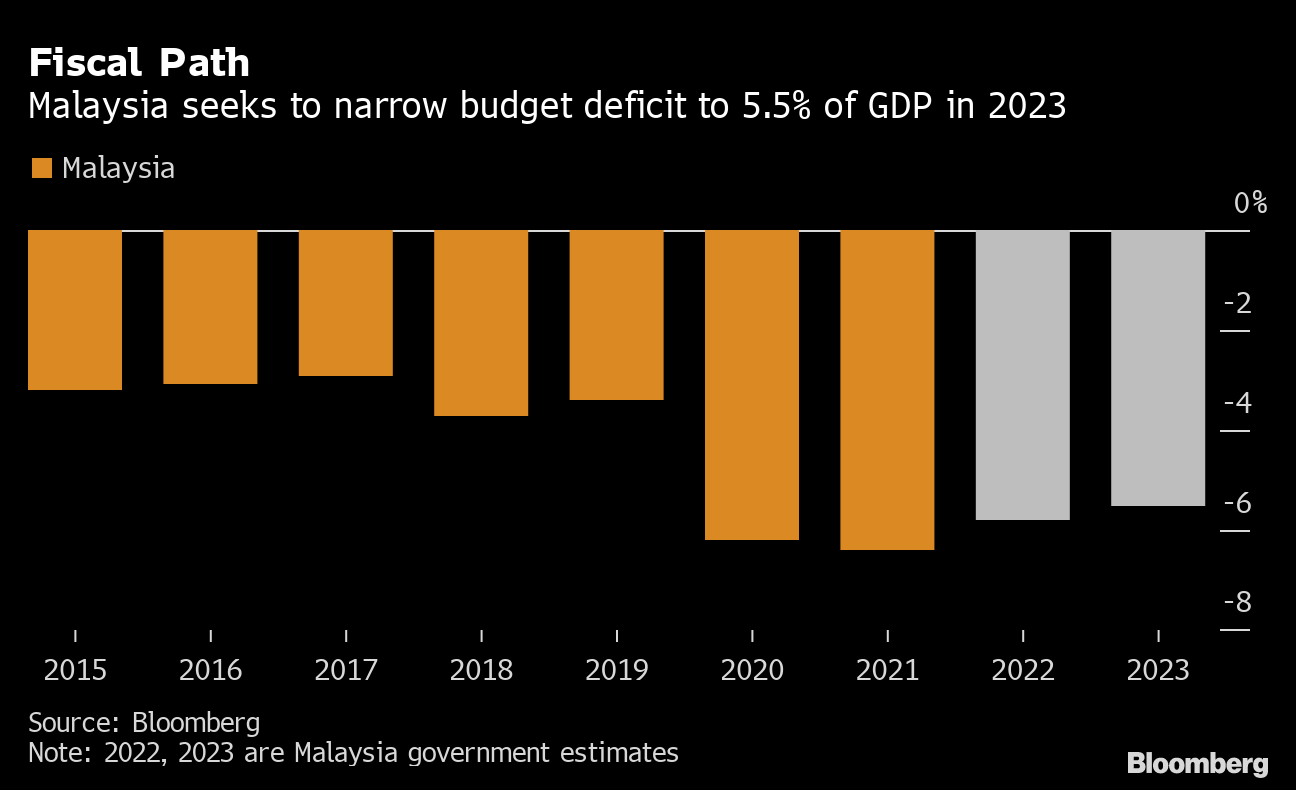

Malaysia S Scaled Back Budget Woos Voters With Tax Cuts Bloomberg

Stamp Duty Calculation Malaysia 2022 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

Kw Malaysia Positive About Stamp Duty Exemption Expected More Measures To Boost Property Market Edgeprop My

Stamp Duty Exemption For House Buyers Infographics Propertyguru Com My

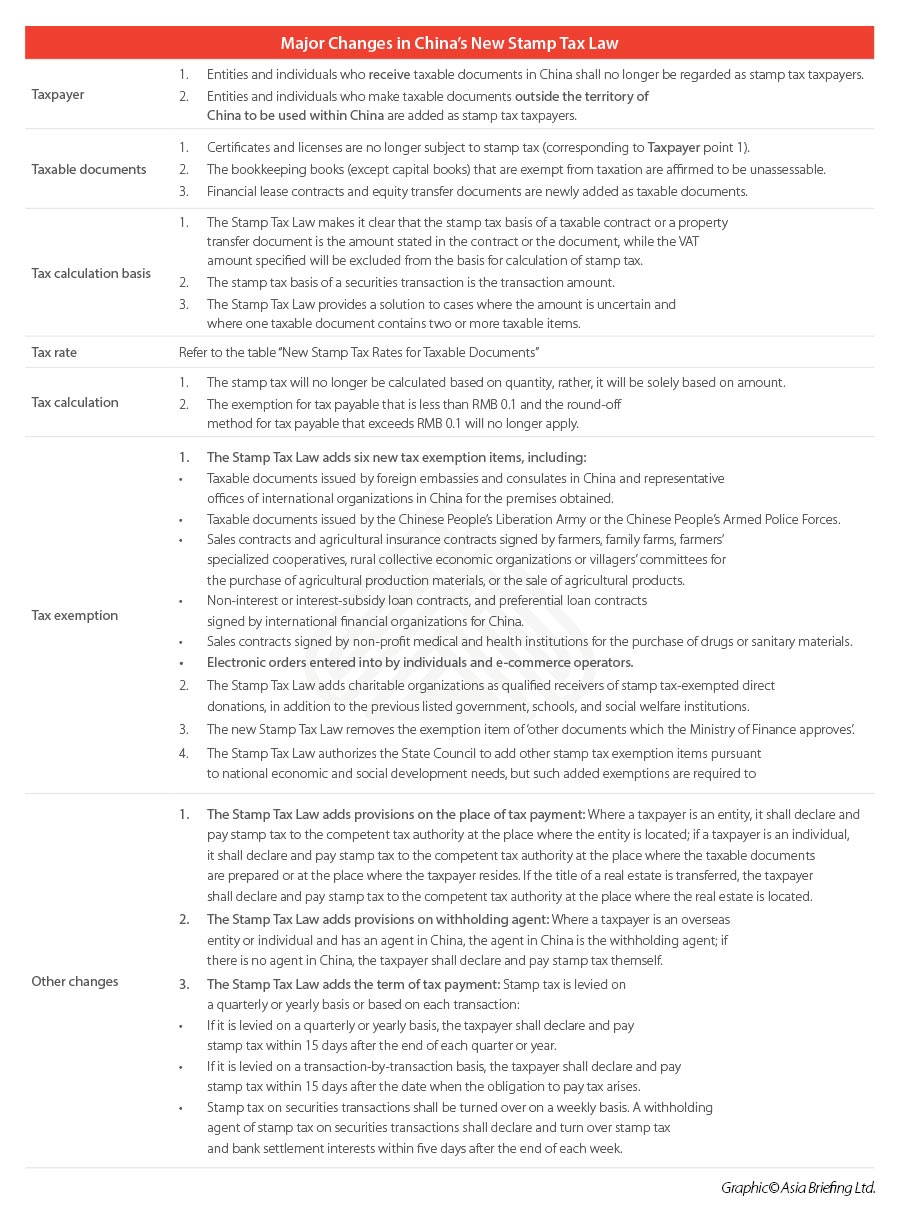

China S New Stamp Tax Law Compliance Rules Tax Rates Exemptions

Budget 2017 Stamp Duty Exemption For Purchases Up To Rm300 000 Edgeprop My

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Lee Lim Stamp Duty Exemption For Special Loan Facilities Facebook

Homebuyers Advised To Save For Stamp Duty Market News Propertyguru Com My

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Corporate Tax Guide Hong Kong Special Administrative Region Htj Tax

Bursa Welcomes Stamp Duty Exemption Trading To Resume The Star

The 2019 Stamp Duty 大马房地产爆料站 Property Insight Malaysia Facebook

Tax Changes In Malaysia S 2022 Budget

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia

0 Response to "stamp duty exemption malaysia 2017"

Post a Comment